India Forklift Market to Double by 2030 as Warehousing, E‑commerce, and Electrification Accelerate Growth

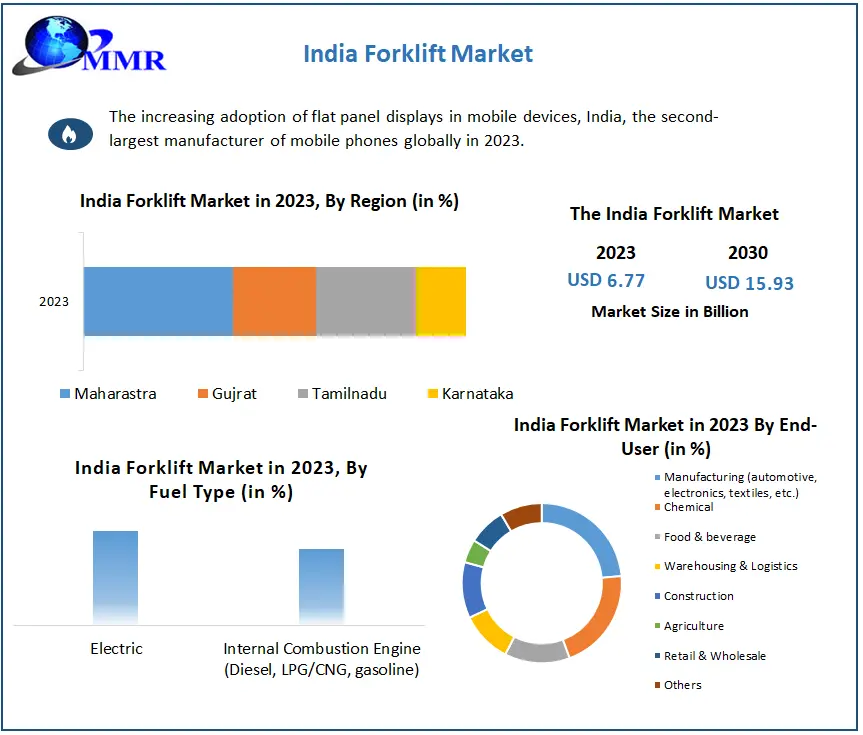

The India forklift market, valued at approximately USD 6.77 billion in 2023, is projected to nearly double and reach USD 15.93 billion by 2030, reflecting an impressive CAGR of 13 percent. This substantial growth is primarily driven by the rapid development of modern warehousing infrastructure, explosive growth in e‑commerce, and increasing demand for environmentally friendly, electric-powered forklifts.

To know about the Research Methodology :https://www.maximizemarketresearch.com/request-sample/29716/

Market Growth Drivers & Opportunity

India's forklift market is undergoing a transformation, catalyzed by several macroeconomic and sectoral shifts. The increasing integration of supply chain automation in logistics and manufacturing sectors is propelling forklift deployment across the country. With warehouse and distribution hubs expanding at an unprecedented pace, particularly in tier 2 and tier 3 cities, forklifts are emerging as critical tools for handling goods efficiently and safely.

Government-led infrastructure programs and policies supporting manufacturing and logistics, such as Make in India, PM Gati Shakti, and the National Logistics Policy, are actively enhancing material-handling demands. The shift towards organized retail and growth in third-party logistics providers is also contributing to forklift adoption.

Simultaneously, environmental concerns and high fuel costs are pushing enterprises to transition from traditional internal combustion engine (ICE) forklifts to electric variants. Technological advancements in lithium-ion batteries, improved energy efficiency, and reduced maintenance costs make electric forklifts a highly attractive option. Moreover, automation and AI-enabled forklifts are gaining traction in high-tech warehouses, further expanding the scope for innovation and value creation in the Indian market.

Segmentation Analysis

The India forklift market demonstrates robust segmentation, reflecting the diverse industrial and commercial needs across regions and applications.

By Class, Class III electric motor hand trucks and rider trucks dominate the market due to their ergonomic design and suitability for small and medium warehouse operations. These are commonly used in retail distribution centers and compact storage spaces. Class I and Class II trucks, typically narrow-aisle electric forklifts, are being increasingly deployed in high-density storage environments to optimize warehouse layouts. Meanwhile, Class IV and V forklifts, powered by internal combustion engines, are preferred for heavy-duty outdoor applications such as in construction, ports, and large-scale manufacturing units.

By Fuel or Power Source, electric forklifts lead the market owing to growing environmental consciousness and operational efficiency. Battery-powered forklifts, especially those using lithium-ion technology, are replacing diesel and LPG-powered variants in warehouses and logistics centers. While ICE forklifts still hold relevance in heavy industries and outdoor operations, their share is gradually declining in favor of electric solutions.

By Load Capacity, forklifts under 5 tons continue to be the most popular due to their flexibility and wide applicability in warehouses and distribution centers. Forklifts with 5 to 15 tons capacity are used extensively in manufacturing, while those with above 16 tons capacity cater to port operations, construction, and mining activities.

By End-Use Industry, the e-commerce and retail sectors are the largest consumers of forklifts, supported by the exponential rise in online shopping and the consequent need for faster inventory turnover. The logistics and transportation sector follows closely, utilizing forklifts in cargo movement, sorting centers, and intermodal operations. Other key sectors include manufacturing, food & beverage, paper & pulp, and chemicals, each requiring forklifts for their specific handling and safety needs.

Request Free Sample Report:https://www.maximizemarketresearch.com/request-sample/29716/

Competitor Analysis

The India forklift market comprises a mix of established domestic players and globally recognized multinational corporations, creating a competitive and innovation-driven ecosystem.

Action Construction Equipment (ACE) stands as a prominent Indian player in the forklift domain, offering a diversified range of electric and diesel forklifts. The company has significantly expanded its export footprint and manufacturing capacity, reinforcing its market leadership within India’s material handling sector.

KION India, operating under the umbrella of the globally recognized KION Group, brings advanced German engineering to the Indian landscape. Known for its precision-driven, high-efficiency forklifts, KION India maintains a strong market presence through localized manufacturing and product innovation tailored to Indian conditions.

Toyota Material Handling India offers a robust portfolio of electric and IC forklifts. Leveraging global R&D and automation expertise, Toyota has been enhancing its offerings with intelligent, energy-efficient models suited for modern logistics environments.

Godrej & Boyce, a trusted Indian brand, has a longstanding presence in the forklift segment. The company is known for its indigenously manufactured forklift trucks and is investing in digital transformation and telematics-enabled models to meet the evolving demands of Indian industry.

Hyundai Construction Equipment India is increasingly focused on sustainability, with advancements in hydrogen and hybrid forklifts designed for industrial and infrastructure-related applications.

Globally recognized brands such as Komatsu, Crown Equipment, Caterpillar, and Jungheinrich also have a presence in the Indian market through strategic partnerships, dealership networks, and technology-sharing agreements. These players are actively introducing automation, smart sensors, and AI-enabled operations in their forklifts, enhancing India’s access to next-generation solutions.

Based on market share and brand presence, the top five players in the India forklift market include Toyota Industries, KION Group, Jungheinrich, Crown Equipment, and Komatsu. These companies benefit from strong distribution networks, advanced technology offerings, and growing localization of their products to suit Indian market conditions.

Recent developments shaping the competitive landscape include ACE expanding its production facilities, Toyota integrating telematics across its product line, and Hyundai collaborating with international technology providers to introduce eco-friendly forklift alternatives. Multinational players are also exploring acquisition opportunities and joint ventures to deepen their roots in the high-growth Indian market.

Conclusion

India’s forklift market is on the cusp of remarkable transformation. Driven by logistics expansion, the rise of organized warehousing, electrification, and digital innovation, the sector is poised for long-term sustainable growth. With electric forklifts leading the market, and automated material handling becoming a core focus for modern supply chains, stakeholders are increasingly aligning their strategies with the evolving industrial landscape.

As global OEMs ramp up their presence and domestic manufacturers invest in innovation and scale, the India forklift market is expected to remain a dynamic and competitive space well into the next decade. Investors, manufacturers, and service providers who align with emerging trends and technological shifts stand to gain significantly in this promising market.

Comments on “India Forklift Market Trends Driving Industrial Efficiency 2030”